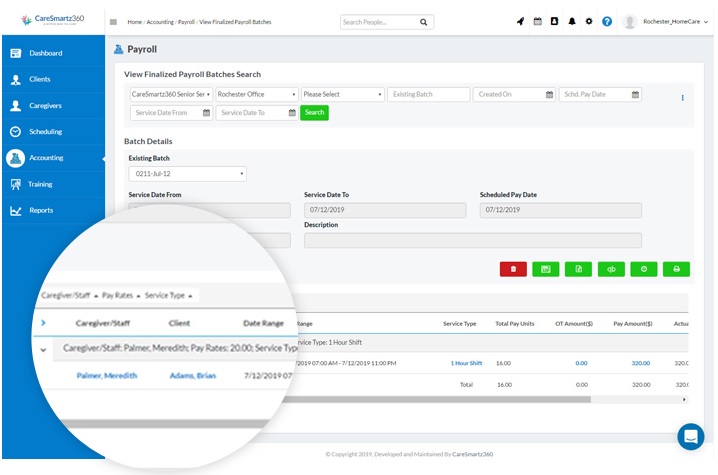

Putting employees to job does come with the expenses. There is stationery, IT support, transportation, meeting and training expenses that help the employees in doing their jobs easily. The organizations need to take into account all the expenses related to the basic processes of the job. By taking in account these expenses, one can find whether the employee contribution created value for the organization in actual sense or not. The management of expenses can be done using payroll software that offers the functionalities, such as:

- Receipt capture: A receipt is the written document of the expense occurred. The accounting professionals or the employees making expense like hotel stay during tour, vendor expenses etc. can upload the related receipts and give the clear picture of the total expenses incurred on a daily basis.

- Per diem: The organizations offer the employment to those people too who work on daily wage basis. Thus, the par diem calculation becomes easy with employee service portal. The managers of accounts of the organization simply put the term of the employment and daily wage rate. The rest is done by the software. Thus, the organizations are able to distribute daily wages without any error to the employee of daily payroll.

- Mileage calculation: Field executives of the employees are on road for the work purposes. This makes them eligible for petrol allowance which is calculated on the basis of the mileage covered. The users of employee expense calculation software can make use of mileage feature and reimburse the road or air travel expense made.

- Vendor management: Employees are served beverages daily. They are also given eating coupons, etc. The vendors offering daily services can be accounted for in the employee portal.

Daily expense is variable in nature and need accounting on a regular basis. Its correct accounting helps in finding the overall expenses incurred by the organization in a year.